Diminishing value method formula

The main negative effect of this law is the fact that the. The salvage value formula requires information like purchase price of the machinery depreciation amount mode of depreciation expected life of the machinery etc.

Written Down Value Method Of Depreciation Calculation

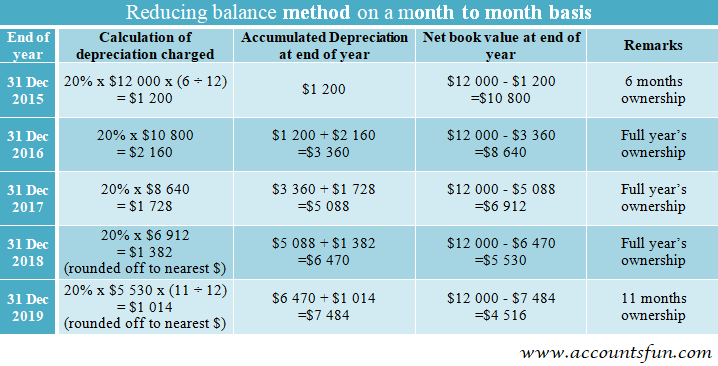

These steps should be repeated annually throughout the assets useful life.

. Free absolute value inequality calculator - solve absolute value inequalities with all the steps. Subtract the depreciation charge from the current book value to calculate the remaining book value. In practice these different feedstocks are typically mixed for multiple reasons.

The consumers willingness to pay is an indicator of the perceived value and hence can be used as a proxy for total utility. This is a classic example of diminishing marginal utility. Utility gained by the consumer with that.

The law of diminishing returns states that a production output has a diminishing increase due to the increase in one input while the other inputs remain fixed. To get the actual value of the scrap or the salvage amount of the machinery. A declining balance method is a common depreciation-calculation system that involves applying the depreciation rate against the non-depreciated balance.

EAF can process pig iron BF products scrap steel recycled and DRI for its steel making. Free absolute value equation calculator - solve absolute value equations with all the steps. Depreciation charge per year net book value residual value x depreciation factor.

Type in any equation to get the solution steps and graph. Declining Balance Method. Costs feedstock availability and product quality control DRI and pig iron are much purer than scrap steel and can be used to improve the steel quality and reduce energy consumption.

BusinessZeal here explores 5 examples of the law of diminishing returns. Type in any inequality to get the solution steps and graph. Marginal Utility Formula Example 2.

But may change if the production method varies. Calculate the depreciation charge using the following formula. These are Straight-line depreciation and Diminishing balance method of depreciation.

Diminishing Balance Depreciation Method Explanation Formula And Example Wikiaccounting

Written Down Value Method Of Depreciation Calculation

Straight Line Method Vs Diminishing Balance Method Depreciation Calculation Examples Youtube

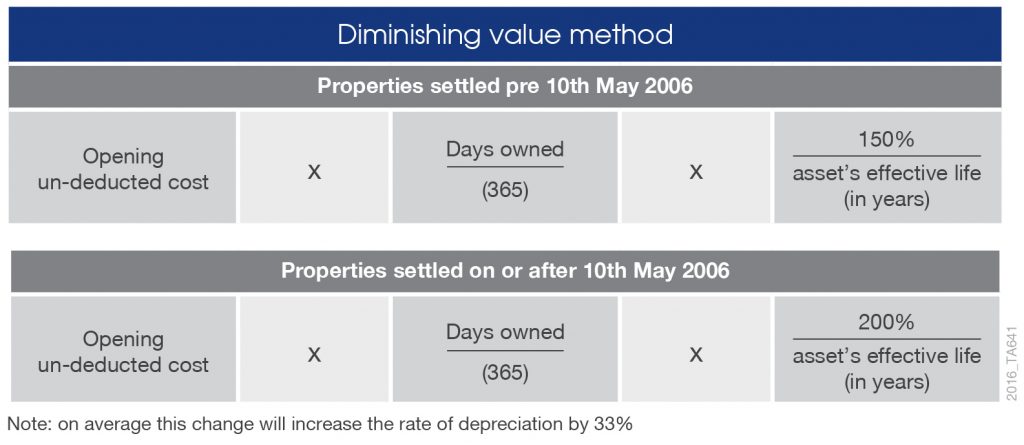

Prime Cost Vs Diminishing Value Depreciation Method Which Is Better Duo Tax Quantity Surveyors

Prime Cost Straight Line And Diminishing Value Methods Australian Taxation Office

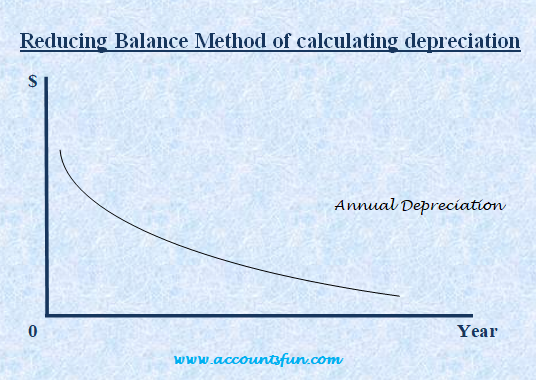

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It

Declining Balance Depreciation Calculator

Written Down Value Method Of Depreciation Calculation

Depreciation Formula Calculate Depreciation Expense

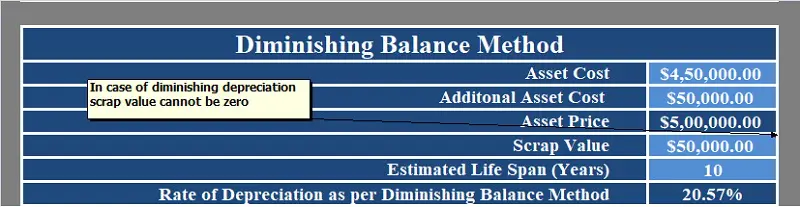

What Is Diminishing Balance Depreciation Definition Formula Accounting Entries Exceldatapro

Diminishing Value Vs The Prime Cost Method By Mortgage House

Calculate Rate Of Depreciation For Diminishing Balance Otosection

Reducing Balance Method For Calculating Depreciation Qs Study

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It

Depreciation Formula Examples With Excel Template

Straight Line Vs Reducing Balance Depreciation Youtube

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It