19+ mortgage deduction

The fight to restore the mortgage insurance tax deduction and make it permanent was revived in Congress with the. To amend the Internal Revenue Code of 1986 to increase the income cap for and make permanent the.

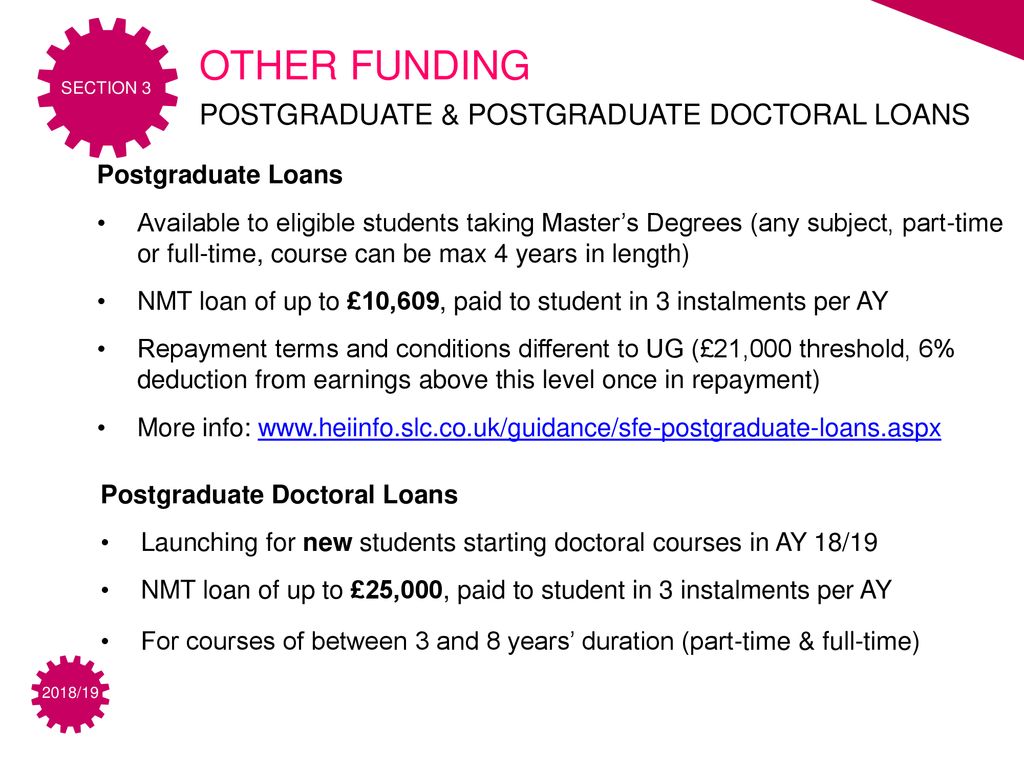

Advanced Learner Loans Jfc Training College

Web 1 day agoOne of the major downsides of being self-employed is that you have to pay both the employer and employee portions of Social Security tax.

. Web The deductions for mortgage interest are safe for now up to at least 500000 homes and this could be 1 million depending upon tax reform that is being. Web All Info for HR1384 - 118th Congress 2023-2024. Homeowners who are married but filing.

Our Tax Experts Will Help You File Fed and State Returns - All Free. As each half amounts to. Web Homeowners with existing mortgages on or before Dec.

Web The Tax Cuts and Jobs Act capped the deduction for state and local taxes including property taxes at 10000 5000 if youre married and filing separately. They also both get an additional standard deduction amount of. Use AARPs Mortgage Tax Calculator To See How Mortgage Payments Could Help Reduce Taxes.

The limit decreased to. Web Most homeowners can deduct all of their mortgage interest. For 2022 the standard deduction is 25900 for married couples and 12950.

While you must deduct the points over the life of the loan ratably equally you dont divide the points by 30 years. If you cant make your mortgage payments because of the coronavirus start by understanding your options and reaching out for help. Web Under the Tax Cuts and Jobs Act TCJA the interest is deductible on acquisition debt up to a 750000 threshold for 2018 through 2025 down from 1.

Instead you divide the points by the number of payments. Web Mortgage relief options. Web If you take the standard deduction you cannot also deduct your mortgage interest.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web For 2022 theyll get the regular standard deduction of 25900 for a married couple filing jointly. Ad For Simple Returns Only.

Web 1 day agoMarch 10 2023 528 pm. Web If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65 percent for a loan term of 30 years heres what you will get to write off as a. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. However higher limitations 1 million 500000 if. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns.

Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and. Web For tax year 2022 what you file in early 2023 the standard deduction is 12950 for single filers 25900 for joint filers and 19400 for heads of household. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Ad File 1040ez Free today for a faster refund. See If You Qualify To File 100 Free w Expert Help. EST 2 Min Read.

15 2017 can deduct interest on a total of 1 million of debt for a first and second home. Web On April 13 2020 the Internal Revenue Service IRS released Revenue Procedure 2020-26 the Revenue Procedure that provides guidance with respect to. Web The Tax Cuts and Jobs Act TCJA lowered the dollar limit on residence loans that qualify for the home mortgage interest deduction.

Calculating The Home Mortgage Interest Deduction Hmid

The History And Possible Future Of The Mortgage Interest Deduction

Advanced Learner Loans Green Labyrinth

Mortgage Interest Deduction Changes In 2018

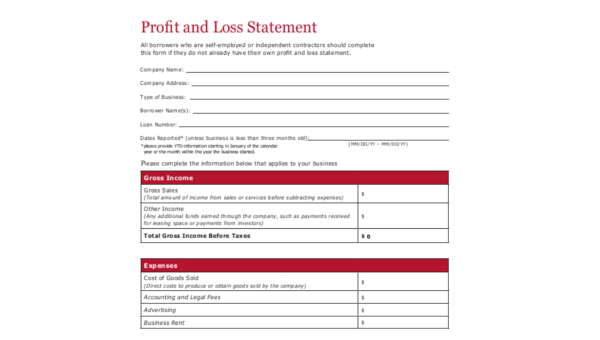

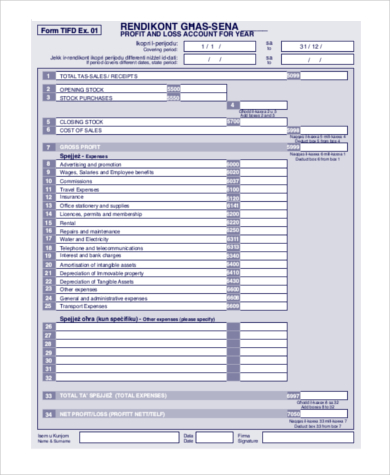

Free 8 Profit And Loss Statement Samples In Ms Excel Pdf

Why The Mortgage Interest Tax Deduction Has Got To Go Streetsblog Usa

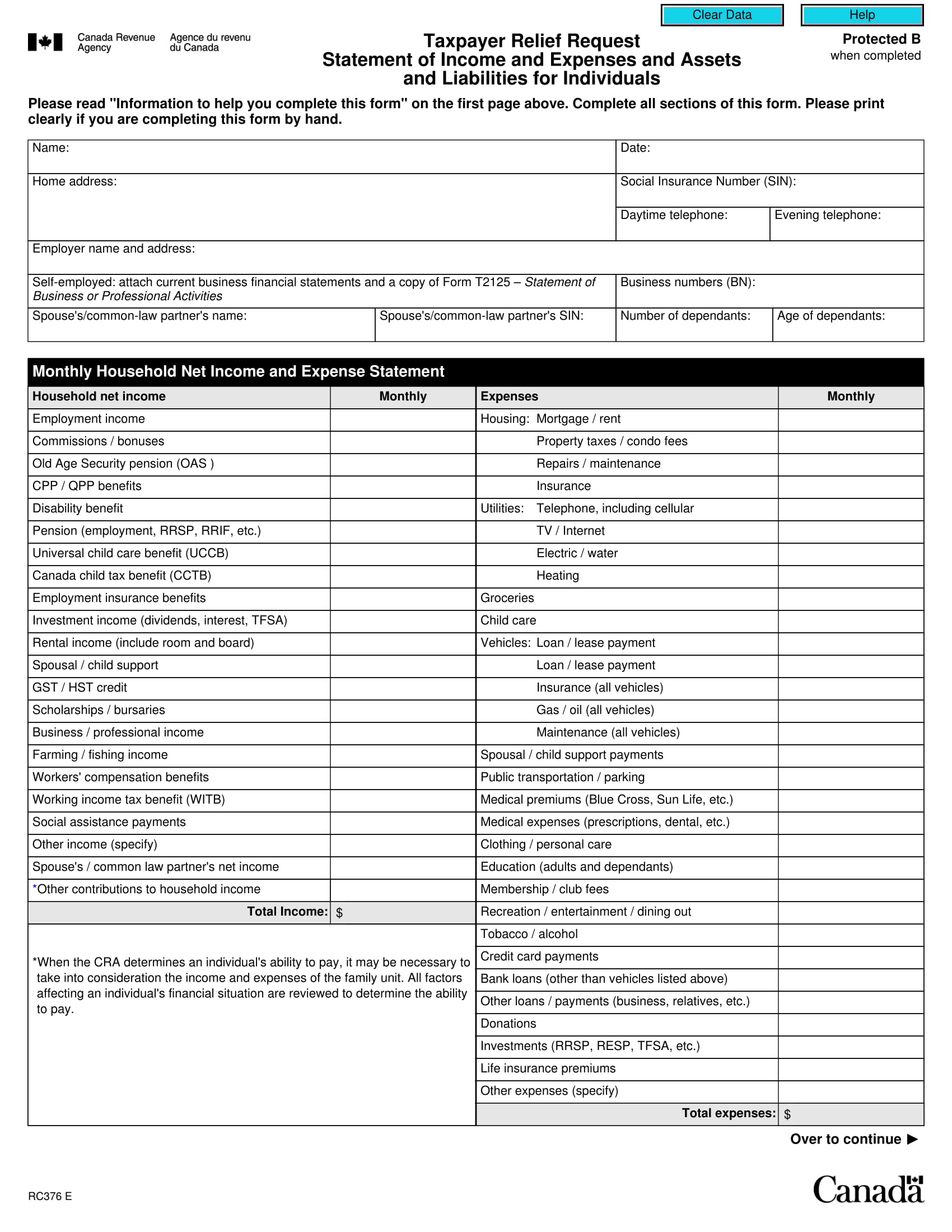

Free 30 Income Statement Forms In Pdf Ms Word

The Benefits Of Executing A 1031 Exchange How You And Your Clients Can Make More Money Mckissock Learning

Free 8 Profit And Loss Statement Samples In Ms Excel Pdf

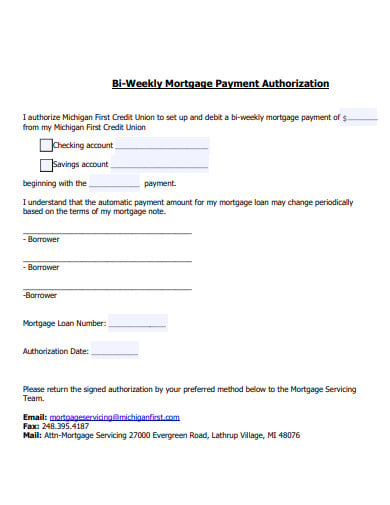

3 Biweekly Mortgage Templates In Pdf

David Tucker With Remax Fine Properties Scottsdale Az

8 Costly Mortgage Misunderstandings Wltx Com

Business Succession Planning And Exit Strategies For The Closely Held

Claiming The Canada Workers Benefit Cwb 2023 Loans Canada

University Of Manchester National Teacher Adviser Conference Ppt Download

Prince Gupta Sur Linkedin Flexibility Location Job Expansion Maintenance Repair Landlord

Pack Of 28 Salary Slip Templates Payslips In 1 Click Word Excel Samples Invoice Template Word Invoice Template Statement Template